Brand Health Tracker: Key Metrics and Methods

Your customers are talking about your brand right now. On Instagram, TikTok, Reddit, review sites — everywhere. Some love what you're doing. Others are frustrated. A few might be switching to your competitors because of something that happened three months ago that you never even noticed.

The question is: are you listening?

In this guide, we'll walk through everything you need to know about tracking brand health. You'll learn what metrics matter, how to set up brand tracking systems that give you actionable insights, and when to worry about what the historical data is telling you.

What is a brand health tracker, and what does it actually do?

A brand health tracker is exactly what it sounds like — a systematic way to measure brand health and how your brand is performing across the metrics that matter most to your business.

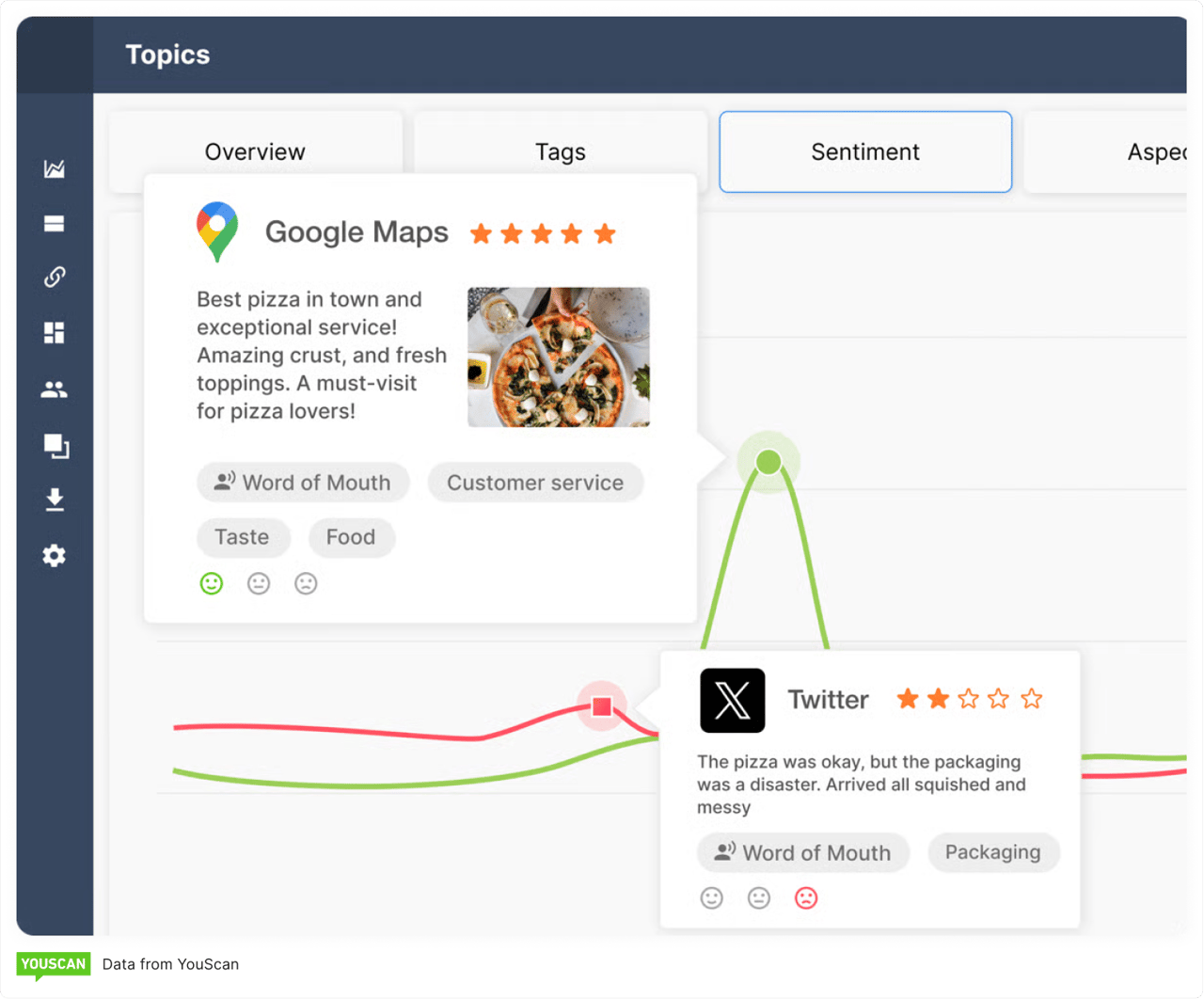

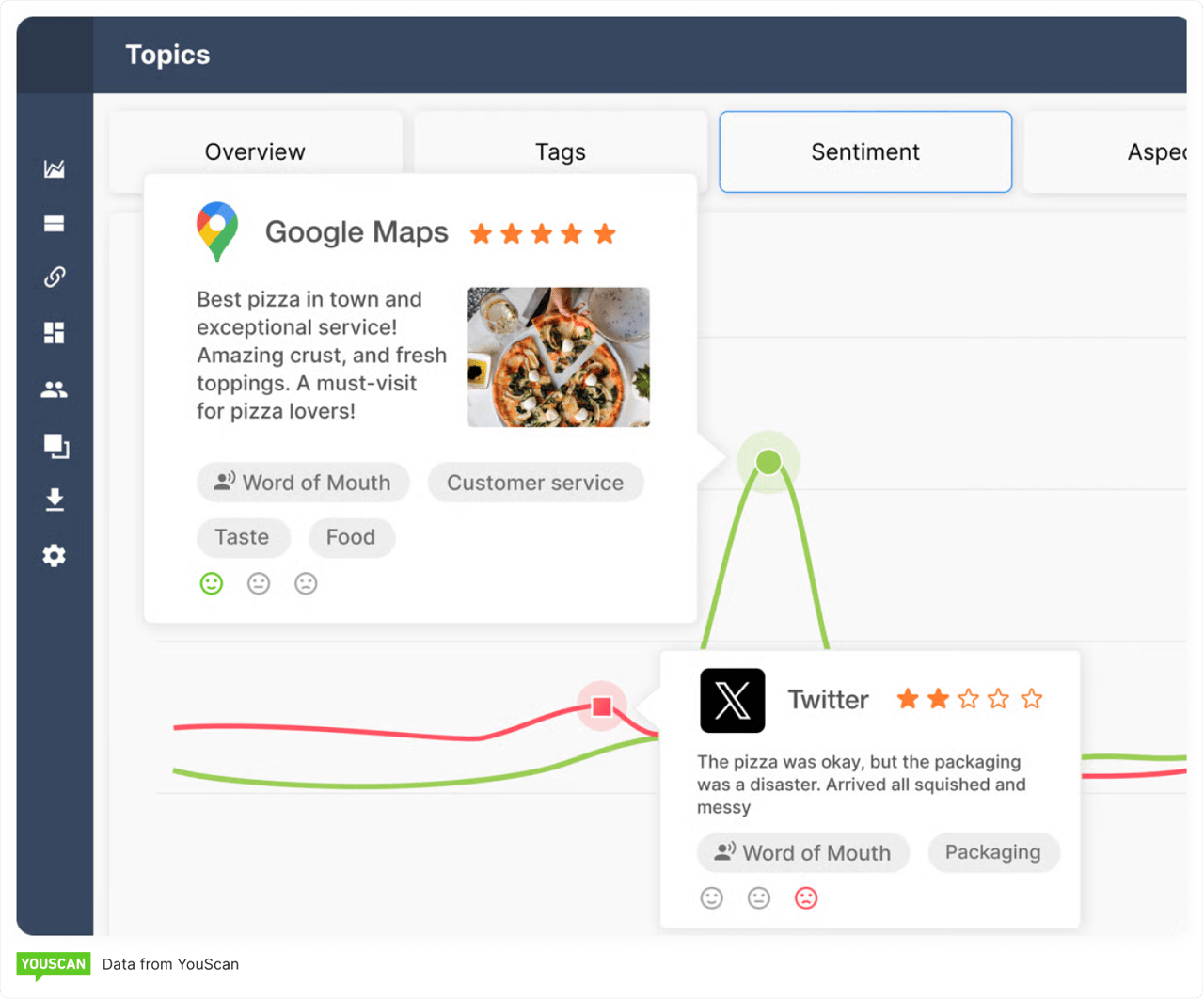

The best brand health systems don't just tell you numbers. They tell you stories. Like how a product launch affected customer sentiment over time, or why your NPS scores dipped right after that influencer partnership, or which competitor is quietly stealing your thunder on social media.

Source: YouScan

How does it work?

Brand tracking works by monitoring multiple data streams simultaneously. Your social listening tools are picking up conversations about your brand across platforms. Your brand tracking surveys are capturing structured feedback.

Your analytics are showing how people behave when they encounter your brand online. Put it all together, and you get a picture of your brand's health that's way more complete than any single metric could provide.

Most brand tracking systems focus on how aware people are of your brand, how they feel about it when they think of it, brand attributes, whether they trust you, and how likely they are to choose you over alternatives. But the magic happens when you track these over time and spot the patterns.

Why tracking brand health is a non-negotiable

Here's the uncomfortable truth: if you're not actively tracking your brand reputation and health, you're flying blind. And in 2025, flying blind is a luxury most businesses can't afford.

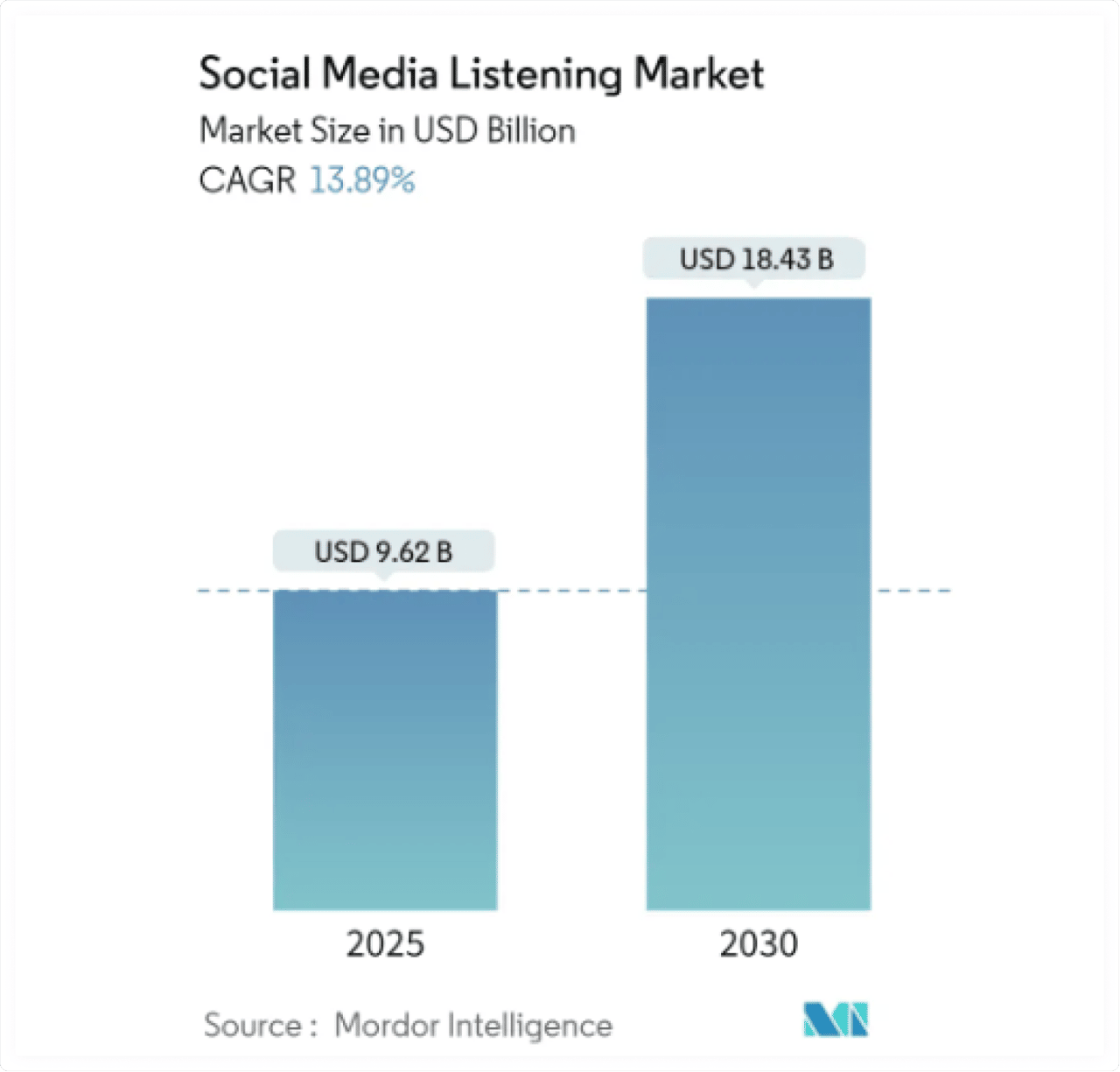

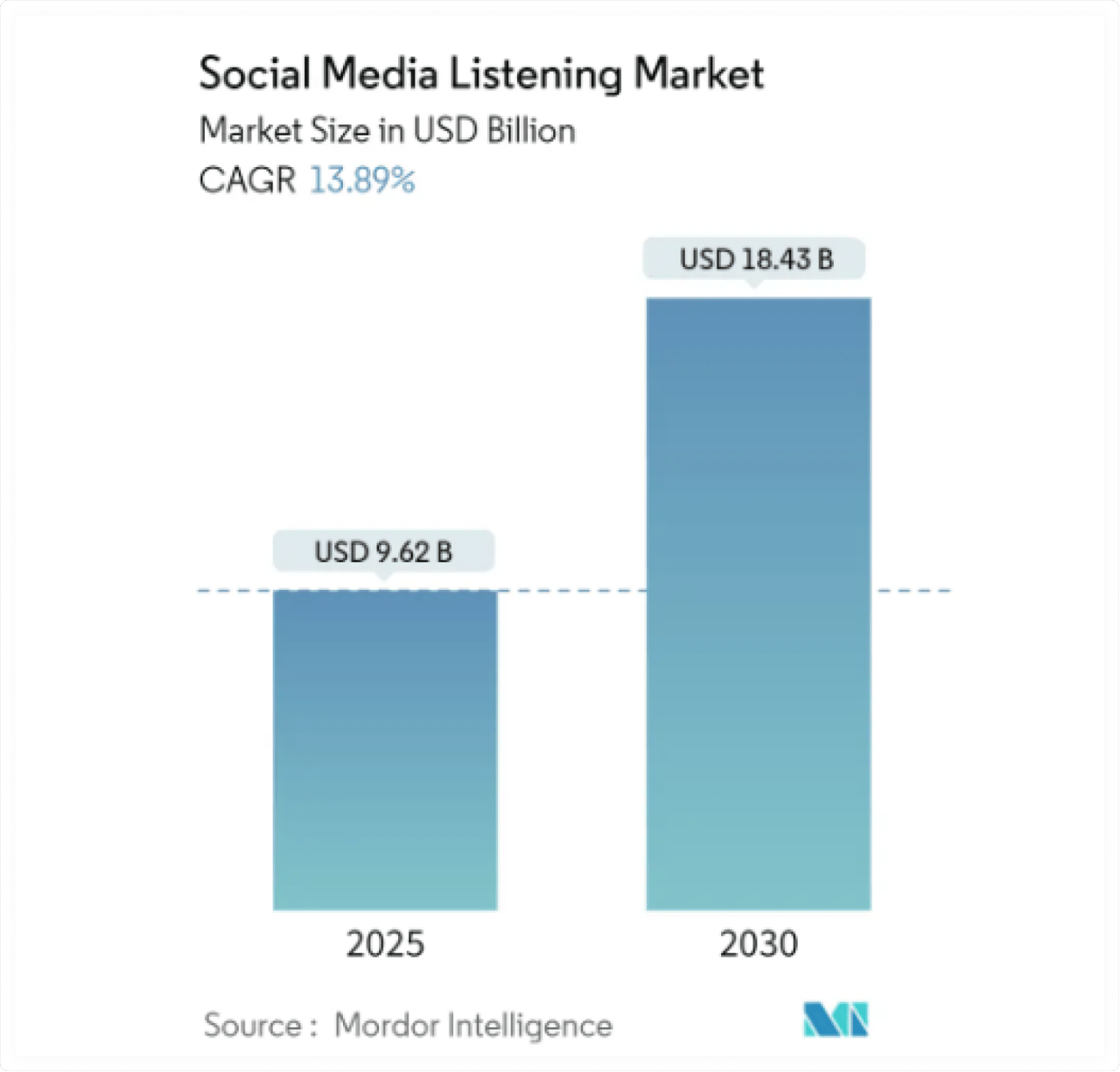

Consider this: the size of the social listening market in 2025 is USD 9.62 billion and is expected to grow to USD 18.43 billion by 2030, highlighting the importance of understanding customer perception. Companies aren't investing billions in brand monitoring tools for fun. They're doing it because the cost of not knowing what people think about your brand is higher than the cost of finding out.

Source: Mordor Intelligence

Without consistent brand health monitoring, you're vulnerable to reputation crises that escalate before you even know they're happening. You miss early warning signs that could save you months of damage control. You make strategic decisions based on outdated assumptions instead of current reality.

Smart brand managers know that reactive approaches don't work anymore, and they rely on customer insights to stay ahead. Your target audiences' opinions change faster than your quarterly reviews. Social media monitoring tools can alert you to problems within hours, not months.

The companies that build strong brands today are the ones that measure brand tracking as routinely as checking their financials. They understand that brand equity and customer trust are assets that need constant attention, not annual check-ups.

The most important brand health metrics (and what they tell you)

Not all brand health metrics are created equal. Some tell you what already happened. Others hint at what's coming. The key is knowing which metrics actually predict future performance and which ones just make nice charts for board presentations.

Here are the key brand health metrics that move the needle:

Brand awareness

Brand awareness measures whether people know you exist and can recall your brand when they're making brand purchase decisions. Brand recall is the foundation metric — if people don't know about you, nothing else matters.

There are two types to track: unaided brand awareness (when people can name your brand without prompts) and aided awareness (when they recognize you from a list). Unaided awareness is gold because it means you're top-of-mind when people think about your category.

Track brand awareness through brand tracking surveys, but also monitor branded search traffic and direct website visits. Social media analytics tools can show you how often people mention your brand unprompted, which is another strong awareness indicator.

Brand sentiment

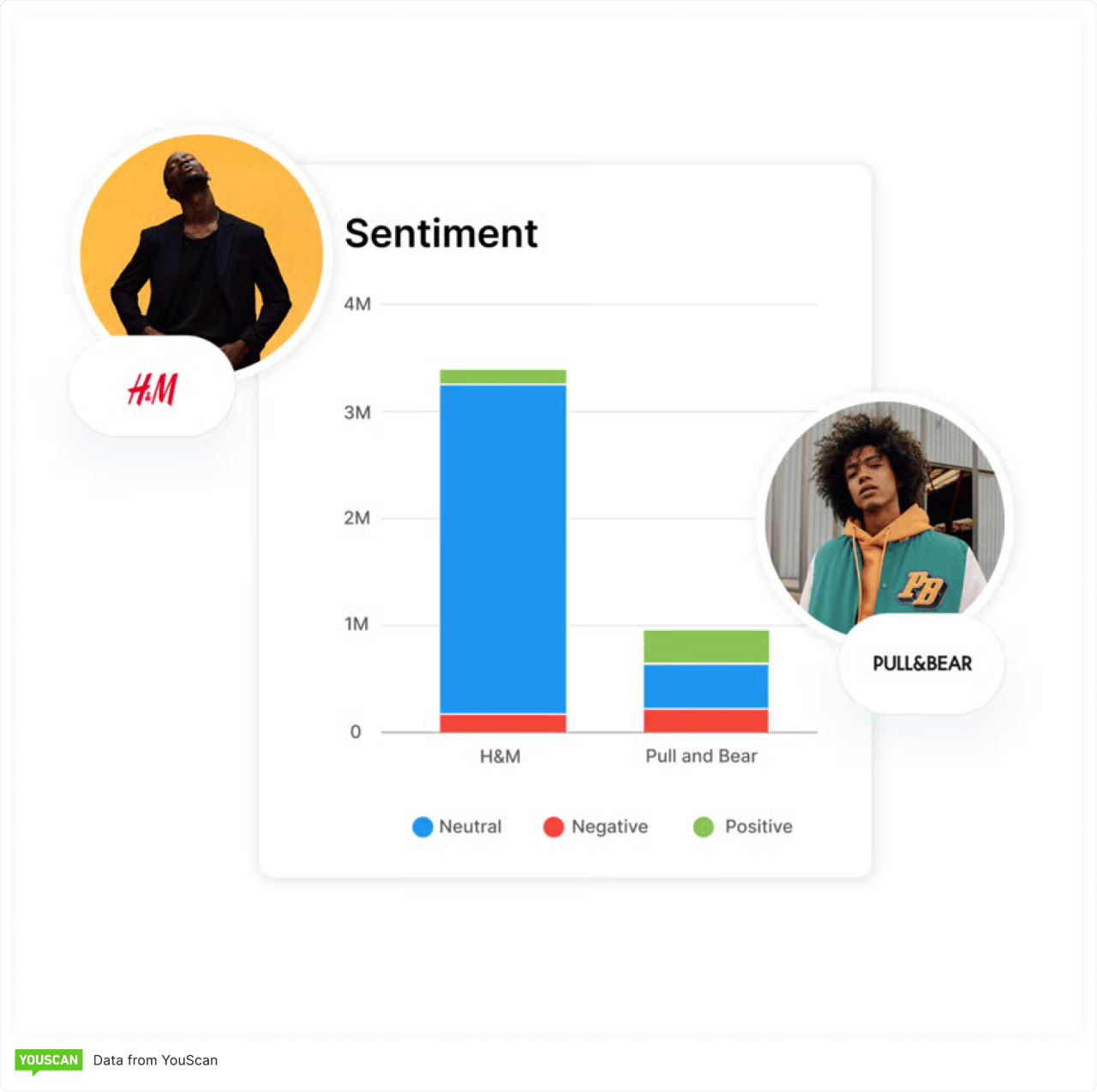

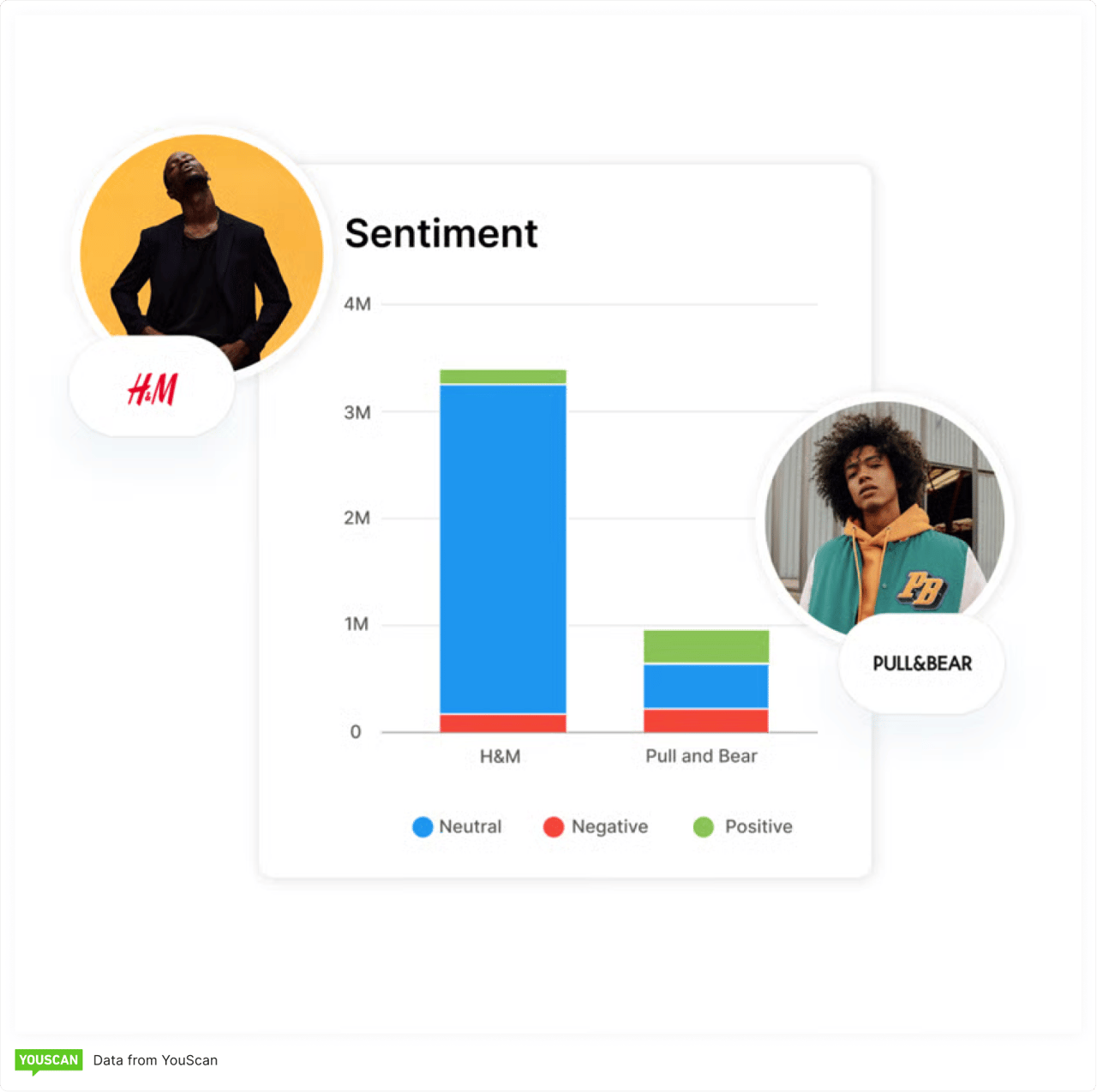

This is where the real insights live. Healthy brand sentiment measures the emotional tone behind what people say about your brand. Are the conversations positive, negative, or neutral? More importantly, are they shifting in any particular direction?

Sentiment analysis tools such as YouScan go beyond simple positive/negative classifications. They can detect emotions like frustration, excitement, disappointment, or trust. They can spot sarcasm and context that older systems missed.

The key is tracking sentiment trends, not just snapshots. A brand might have 70% positive sentiment this month, but if that's down from 85% last month, you need to investigate what changed. Brand sentiment analysis helps you spot these shifts before they impact your bottom line.

Watch for sentiment spikes around product launches, advertising campaigns, or competitor moves. The healthy brands that respond quickly to sentiment changes are the ones that build stronger relationships with their customers over time.

Source: YouScan

Brand trust

Trust is the metric that separates strong brands from flashy ones and reflects overall brand strength. Brand trust reflects whether people believe in your promises, quality, and reliability. It's harder to measure than awareness, but more predictive of customer loyalty and long-term success.

Trust shows up in multiple ways. Net Promoter Scores, review ratings, return customer rates, and even how people talk about your brand in organic conversations. When someone says, "I always go with [your brand] because I know they're reliable," that's trust talking.

The challenge is that trust takes time to build but can disappear quickly. One bad customer experience shared widely on social media can undo months of trust-building efforts for potential customers. That's why brand reputation monitoring needs to be continuous, not periodic.

Companies with high brand trust see higher customer satisfaction scores, better employee experience and retention, and more forgiveness when things go wrong. Trust is the foundation of brand loyalty and customer advocacy.

Brand preference

Brand preference measures whether people would choose your brand over other brands when making a purchase decision. This metric bridges perception and behavior — it's not enough for people to know about you or even like you. They need to prefer you.

Preference is often measured by following brands through choice-based brand tracking surveys, but you can also track it through market share changes, conversion rates, and competitive analysis. When people have multiple options and consistently choose yours, that's preference in action.

Track preference by demographic, geography, and purchase occasion. You might find that you're preferred for everyday purchases but not special occasions, or vice versa. These insights guide brand strategy and messaging decisions.

Net Promoter Score (NPS)

Net promoter score measures how likely customers are to recommend your brand to others. It's widely used because it's simple to calculate and correlates with business growth, though it has limitations.

The formula is straightforward: NPS = % Promoters – % Detractors. Promoters (scores 9-10) are your brand advocates. Detractors (scores 0-6) are at risk of negative word-of-mouth.

NPS is useful for trending and benchmarking, but it works best when combined with other brand metrics. A brand might have a decent NPS but declining brand sentiment on social media, which suggests near-future problems, even if current customers are satisfied.

The real value in NPS comes from the follow-up questions. Why did someone give that score? What would it take to move them higher? The qualitative feedback often provides more actionable insights than the number itself.

Purchase intent

This metric predicts future behavior by measuring how likely people are to buy from your brand soon. Consumer purchase intent bridges brand perception with revenue potential.

Track purchase intent through brand surveys, but also monitor behavioral signals like website engagement, email click-through rates, and social media interactions. People who engage deeply with your content often show higher purchase intent even before they explicitly state it.

The timing of purchase intent measurement matters. Intent right after an advertising campaign might be artificially high. Intent measured during competitor product launches might be unusually low. Track it consistently to identify real trends versus temporary fluctuations.

Purchase intent data collection helps you predict the sales pipeline and adjust marketing spend. Brands that see declining intent despite strong awareness and sentiment know they need to work on conversion factors like pricing, availability, or competitive brand positioning.

Source: YouScan

How to track brand health (without drowning in data)

The biggest mistake brands make with brand tracking isn't collecting too little data — it's collecting too much without a clear plan for what to do with it. The goal is insight, not information overload.

Here's how to set up brand tracking that helps you make better decisions:

Start with brand surveys, but don't stop there

Traditional brand tracking surveys are still valuable, but they're slow and expensive. Use them for baseline measurements and deep dives into specific questions. Send them quarterly or biannually to track major trends in brand awareness, preference, and trust.

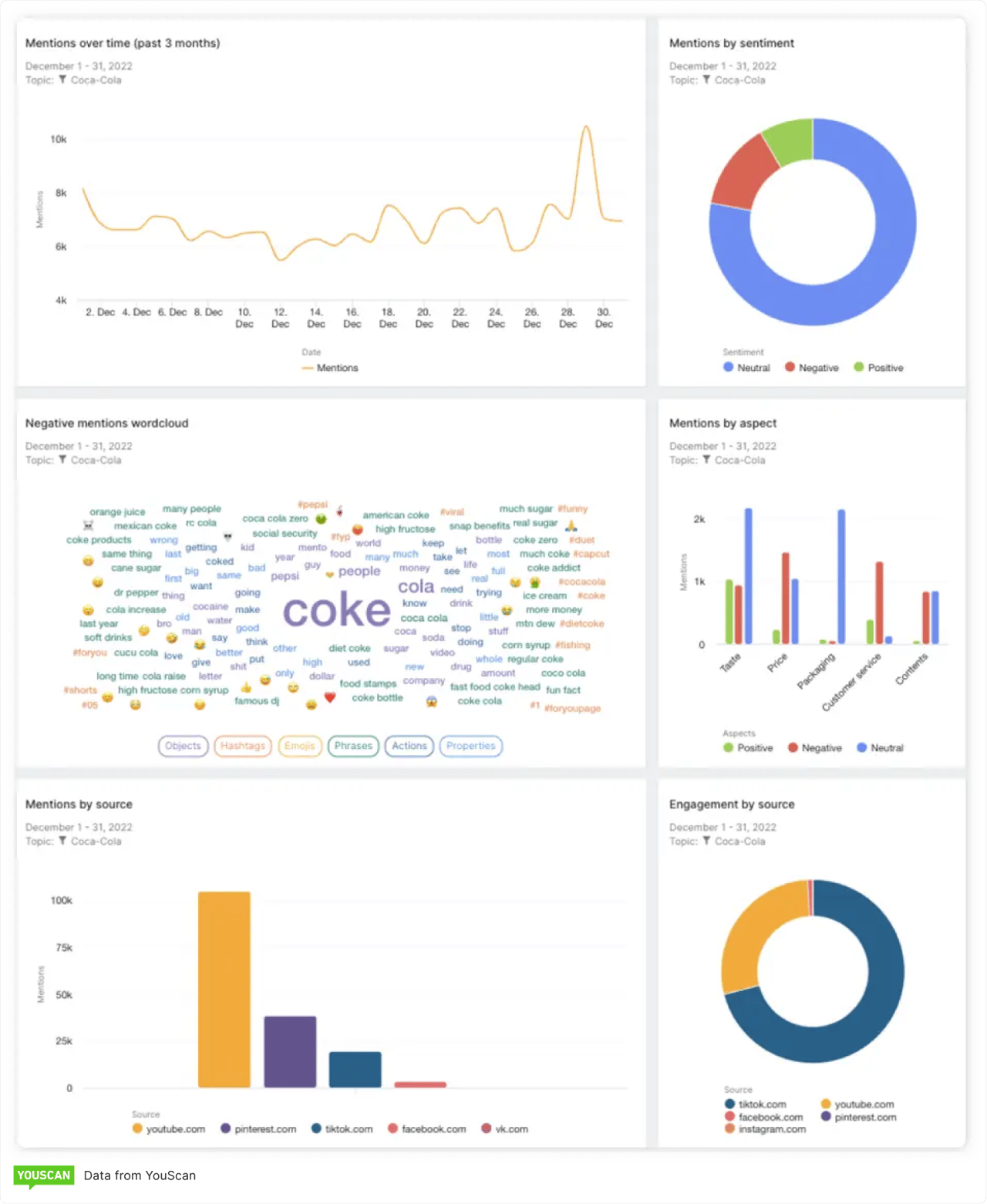

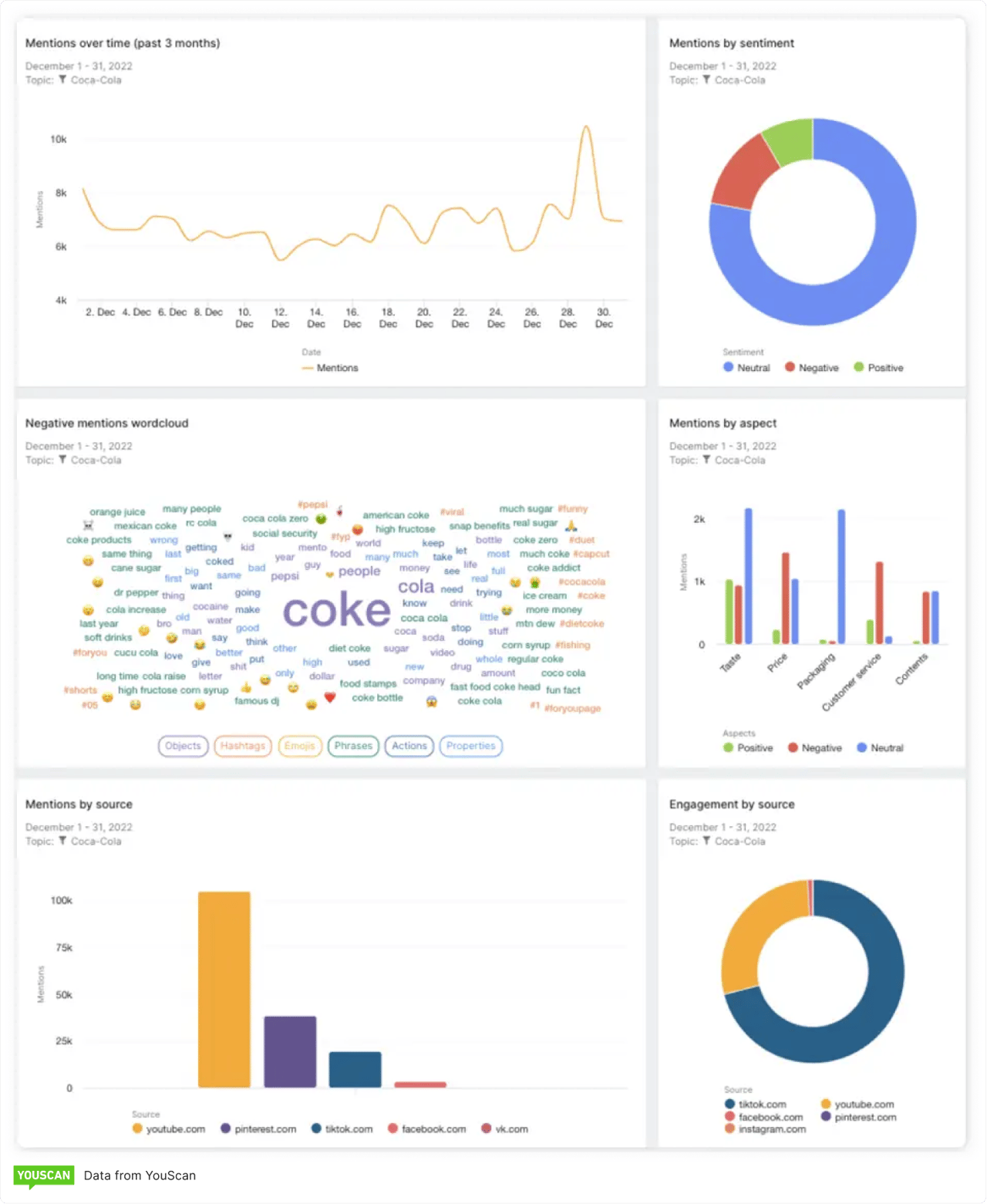

Embrace social listening for real-time insights

Social media listening gives you immediate access to unfiltered customer opinions. People share honest thoughts and share their brand attitude on social platforms that they'd never put in a survey response.

The advantage of social listening is speed. You can spot problems within hours of them emerging and respond before they escalate. You can also identify unexpected positive conversations and amplify them through your marketing channels.

Use customer feedback analysis strategically

Your customer feedback from reviews, support tickets, and direct communications contains valuable brand health signals. The language people use, the problems they report, and the emotions they express all reflect your brand's health.

Don't just track review ratings — analyze the actual text for themes and sentiment shifts. A brand might maintain a 4.2-star average but see increasing complaints about a specific issue. That's an early warning signal that wouldn't show up in aggregate ratings.

Look for patterns across feedback channels. When the same issue appears in social mentions, support tickets, and reviews, it's a systemic problem that needs immediate attention.

Connect the dots between channels

The most valuable insights come from connecting data across multiple sources. When social sentiment drops at the same time that customer satisfaction scores decline and support ticket volume increases, you have a clear signal that something fundamental needs attention.

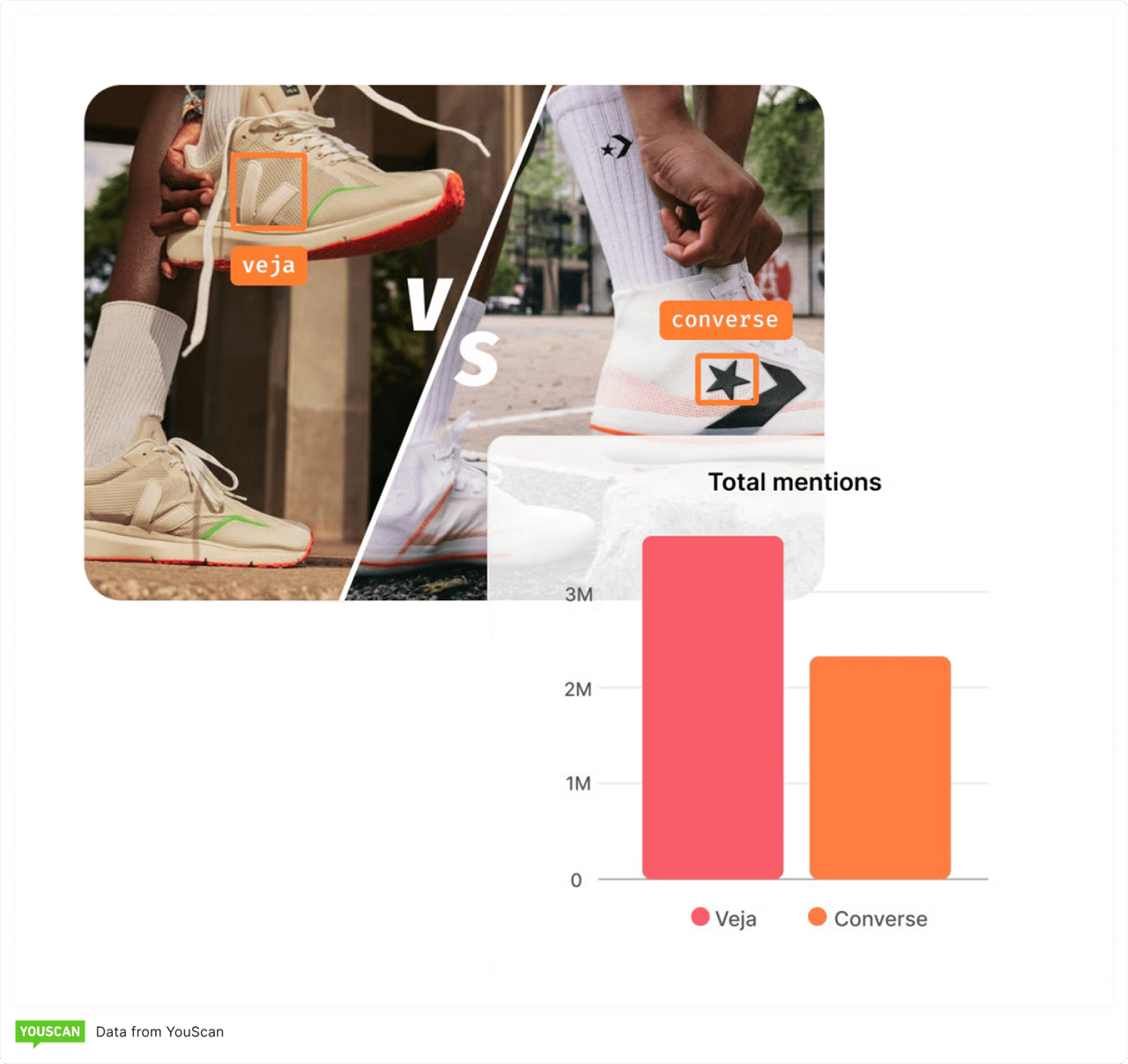

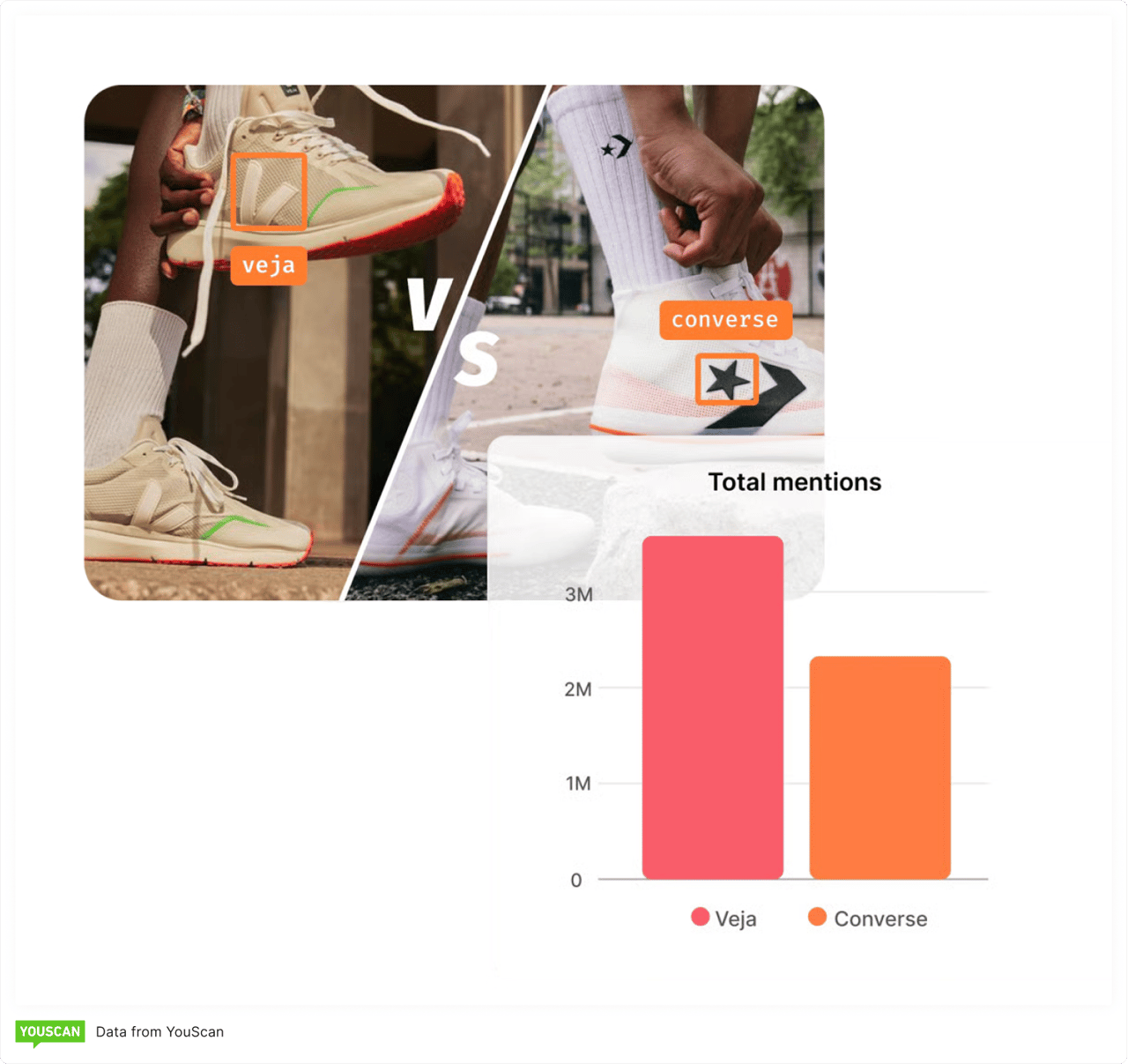

Use trend analysis tools to spot correlations between different metrics. Sometimes the connection isn't obvious — a competitor's product launch might affect your brand sentiment even if your products haven't changed.

The brands that excel at brand tracking treat it as an integrated system, not a collection of separate measurements.

Tools worth using if you're serious about brand health

The brand monitoring landscape includes everything from basic survey platforms to sophisticated AI-powered analysis systems. The key is choosing tools that match your business needs and budget without creating more complexity than value.

Social listening for real-time monitoring

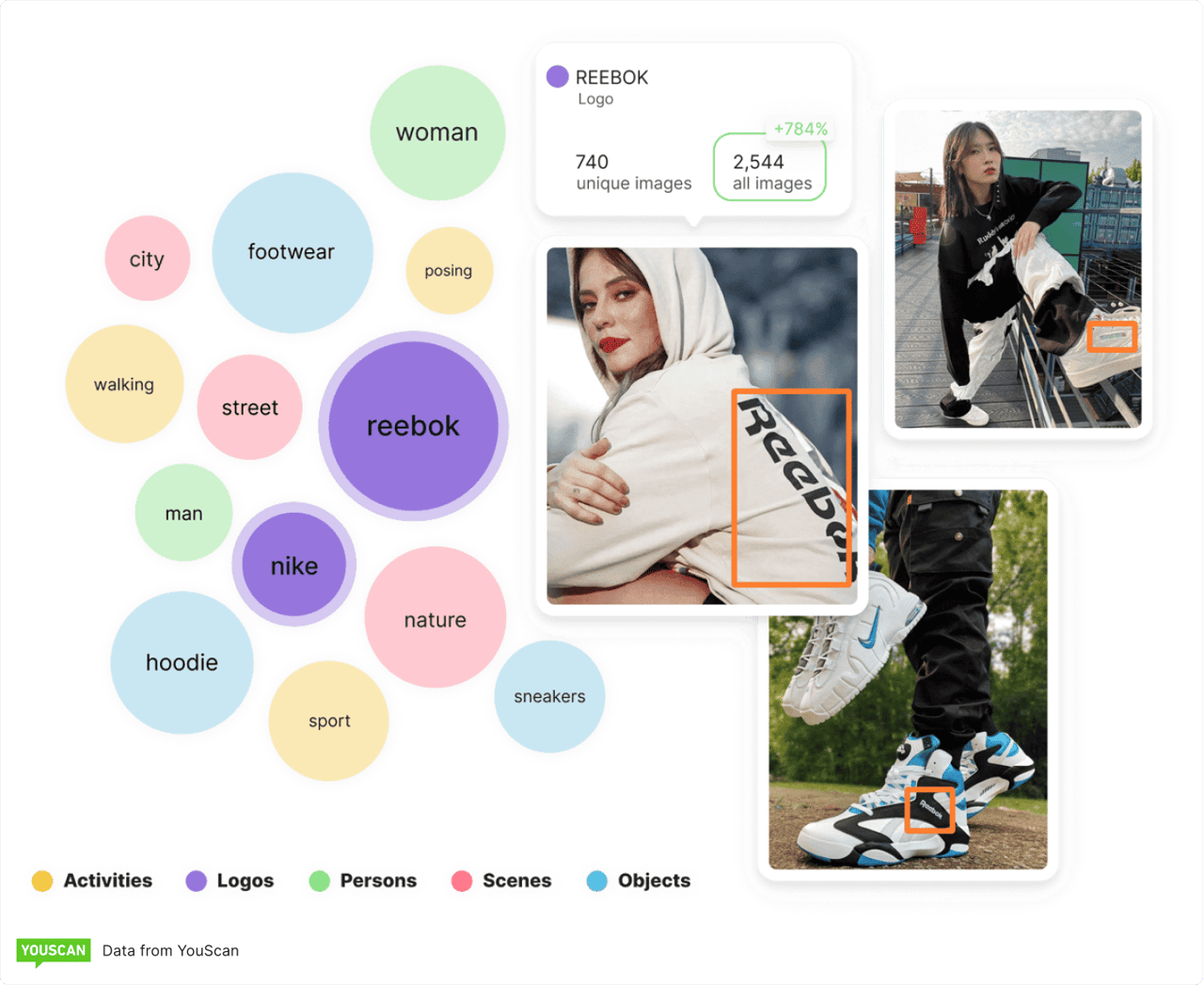

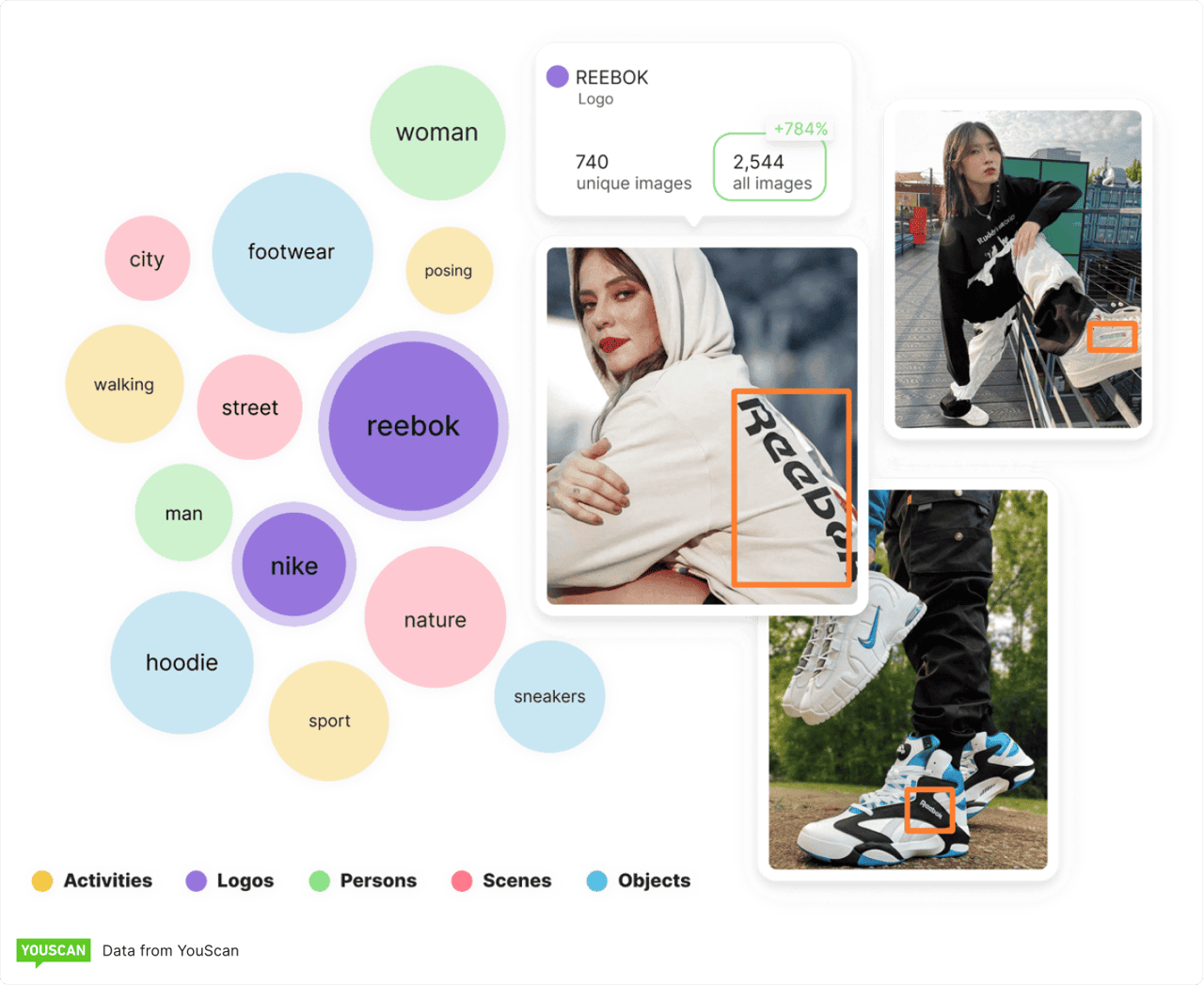

This is where tools like YouScan excel. AI-powered social listening tools can monitor millions of online conversations simultaneously, analyze sentiment, detect visual content, and alert you to significant changes as they happen.

YouScan's Visual Insights feature can even identify your logo or products in images shared across social platforms, giving you visibility into how your brand appears in user-generated content. This level of monitoring was impossible just a few years ago.

Source: YouScan

Survey platforms for structured insights

Qualtrics and SurveyMonkey remain popular choices for traditional brand tracking surveys. They're good for baseline measurements and detailed demographic analysis. Use them when you need statistically significant sample sizes and formal research methodologies.

These platforms work well for tracking brand awareness, preference, and purchase intent over time. They're less useful for real-time monitoring or unexpected issue detection.

Source: YouScan

Analytics platforms for behavioral data

Google Analytics, social media analytics, and customer data platforms provide behavioral signals about brand health. Website engagement metrics, social media interaction rates, and email performance all reflect how people respond to your brand, not just what they say about it.

Integrated solutions for comprehensive brand tracking

The most sophisticated brands use platforms that combine multiple data sources. These tools pull in survey data, social mentions, review sites, customer feedback, and behavioral analytics to create comprehensive brand health dashboards.

The benefit of integration is context. When you see a sentiment spike, you can immediately check whether it correlates with sales changes, website traffic, or campaign performance.

How often should you check in on brand health?

The frequency of brand health monitoring depends on your industry, competitive environment, and current business priorities. But here's the general rule: some metrics need daily attention, other brand data works fine on a monthly or quarterly schedule.

Real-time monitoring for brand reputation management

Brand sentiment and brand mentions should be monitored continuously. Social media conversations, review sites, and news mentions can affect your brand's health within hours.

Crisis management requires immediate response capability, which means constant monitoring. Set up alerts for significant changes in mention volume, sentiment scores, or unusual conversation topics.

Weekly brand tracking for operational insights

Customer satisfaction metrics, support ticket themes, and social media engagement rates provide valuable weekly insights. This frequency lets you spot developing issues before they become major problems while avoiding the noise of daily fluctuations.

Weekly reviews work well for brand managers who need to stay current but don't want to be overwhelmed by constant data streams.

Monthly analysis for strategic planning

Brand awareness, brand preference, and competitive positioning metrics work well on monthly cycles. These measures change more slowly and benefit from longer observation periods to identify real trends versus temporary variations.

Monthly reports should include trend analysis and comparison to previous periods. Look for patterns that might not be obvious in shorter timeframes.

Quarterly deep dives for major decisions

Comprehensive brand health assessments work best quarterly. These should include structured surveys, competitive benchmarking, and strategic analysis of how your brand's health supports your business objectives.

Quarterly reviews are perfect for board presentations, strategic planning sessions, and major campaign planning. They provide enough data to make confident decisions while being recent enough to be actionable.

Campaign-specific brand tracking

Launch a new product? Run a major advertising campaign? Enter a new market? These events require dedicated brand tracking periods to measure impact and effectiveness.

Set up specific measurement periods before, during, and after major brand activities. This helps you understand what worked, what didn't, and how to optimize future efforts.

Adjust frequency based on circumstances

Rapidly growing companies often need more frequent monitoring because their brand health can change quickly. Established brands in stable markets might check less often. Crises require daily monitoring until issues are resolved.

The key is consistency over perfection. It's better to check the right metrics monthly than to check everything weekly and get overwhelmed by the data volume.

From metrics to action: How to actually use the data

Collecting brand health data is only valuable if you act on what you discover. The most successful brands treat their tracking systems as early warning networks that guide strategic decisions and tactical improvements.

Use anomaly detection for rapid response

Set up your brand tracking systems to alert you when metrics move outside normal ranges. A sudden spike in negative mentions, an unusual drop in brand awareness, or unexpected changes in competitive share of voice all warrant immediate attention.

The brands that respond fastest to anomalies often contain problems before they spread. Quick response can turn potential crises into opportunities to demonstrate excellent customer service.

Connect brand health to business outcomes

Track how changes in brand health correlate with sales, customer acquisition costs, and customer retention rates. This helps you understand which brand metrics predict business performance versus which ones just look good on dashboards.

For example, you might discover that brand trust scores predict customer loyalty better than NPS scores in your industry. That insight should shift your brand tracking priorities and improvement efforts.

Guide messaging and campaign strategy

Use brand health data to inform your content strategy and messaging priorities. If customers consistently mention a particular benefit in positive brand mentions, emphasize that benefit in your marketing materials.

When competitive analysis shows competitors gaining ground on specific brand attributes, develop campaigns that reinforce your advantages in those areas.

Source: YouScan

Inform product and service improvements

Brand health data often reveals product issues before they show up in sales numbers, thanks to a machine learning algorithm. Declining customer satisfaction scores, negative sentiment themes, or increasing complaint volume all signal areas that need operational attention.

The most valuable brand health insights are the ones that help you fix problems customers didn't even know they could complain about yet. That's what gives you a competitive edge.

Final thoughts on brand health tracking

Your brand's health isn't something you can assess once a year and forget about. In 2025, public perceptions shift quickly, competitive landscapes change constantly, and customer expectations evolve faster than traditional research can track.

The brands that measure consistently are the ones that adapt successfully. In a world where customer opinions spread instantly and competitive advantages disappear quickly, staying informed isn't optional.

Request a YouScan demo to see how real-time brand health tracking can help you stay ahead of changes and make smarter decisions about your brand's future.

FAQs

What is a brand health tracker?

A brand health tracker is a system that measures and monitors key metrics about your brand's performance and perception over time. It typically tracks metrics like brand awareness, sentiment, trust, preference, and competitive positioning to provide insights into your brand's strength and areas for improvement.

What is a brand health check?

A brand health check is a comprehensive assessment of your brand's current performance across multiple dimensions. It includes analysis of brand perception, customer satisfaction, competitive positioning, messaging consistency, and market share.

What is an example of brand tracking?

A typical brand tracking example might involve monitoring your brand's monthly Net Promoter Score alongside social media brand sentiment and brand awareness survey results. For instance, tracking how these metrics change before, during, and after a major advertising campaign to measure the campaign's impact on overall brand health.

How to calculate brand health score?

Brand health scores combine multiple weighted metrics into a single index. A common approach weighs brand awareness (25%), brand sentiment (30%), customer satisfaction (25%), and brand preference (20%).

![What Is PR in Social Media? Complete Rundown [2026]](https://cdn-legacy.youscan.io/cdn-cgi/image/metadata=copyright,format=auto,fit=contain,quality=70,width=1280/what-is-pr-in-social-media_.png)